Boat Sales Tax North Carolina

Sales tax is imposed if. I purloined the three messages below from the GL Great Loop mail list.

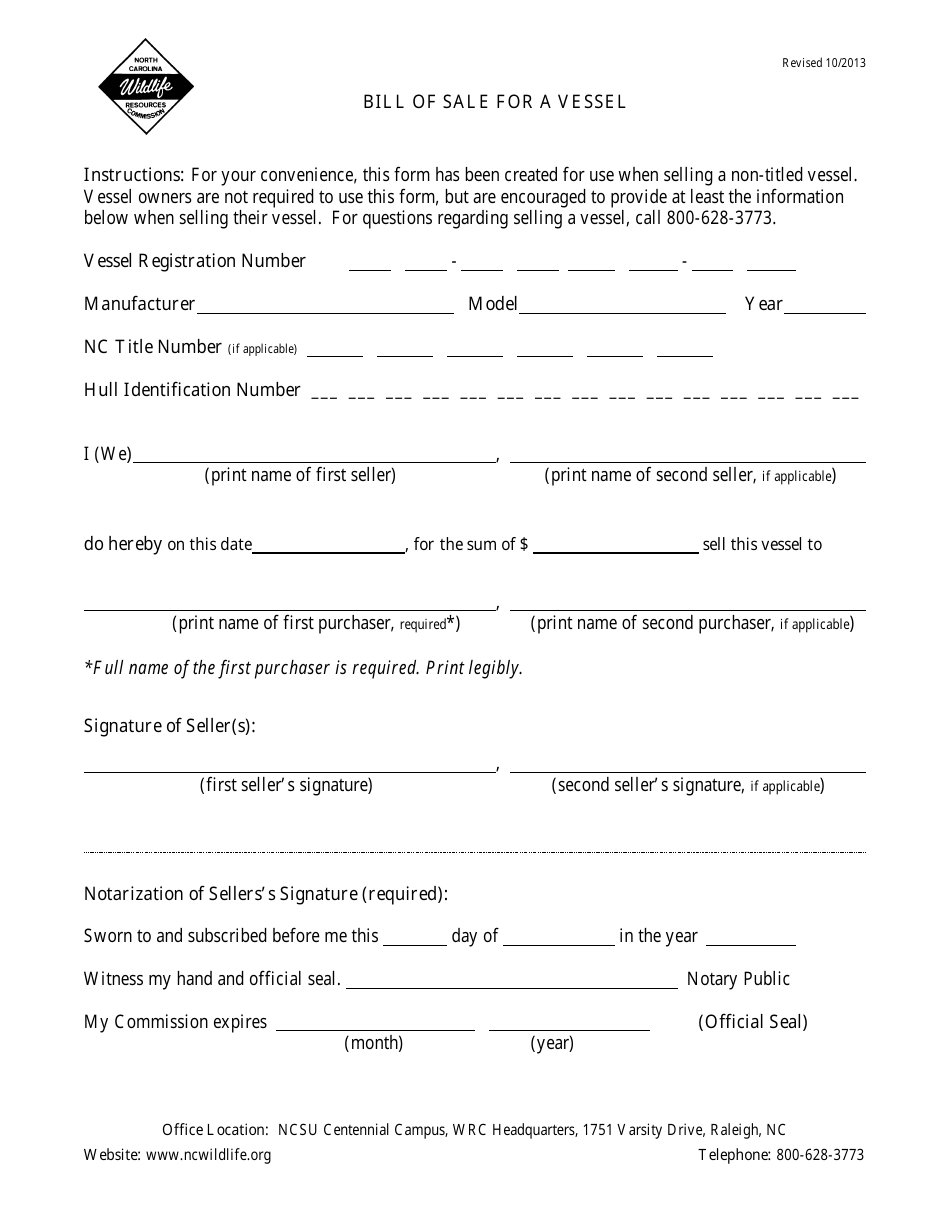

North Carolina Bill Of Sale For A Vessel Download Fillable Pdf Templateroller

Prescription Drugs are exempt from the North Carolina sales tax.

Boat sales tax north carolina

. The use tax is paid to the North Carolina Department of Revenue by the purchaser when the North Carolina tax has not been collected by the retailer. North Carolina has 1012 special sales tax jurisdictions with local sales taxes in addition to. This includes both sales and use tax and discretionary sales surtax.If the seller is an individual and the vessel is registered in North Carolina or another state but not titled a notarized Bill Of Sale is proof-of-ownership. Boat is legally registered both with Federal Documentation and State Docs in RI. 35 with a tax cap of 20000 New York.

Property tax rates are based on the physical location of the property. It must include the registration number the hull ID number and a vessel description. North Carolina Sales Tax.

Boats And Property Tax in North Carolina. A boat trailer sold alone is taxed at 6 of the purchase price. Boat trailers are subject to the 3 highway use tax and are not subject to sales or use tax.

The use tax is also due on taxable services sourced to North Carolina. There is no federal vessel tax and may the federal luxury tax stay good and dead so taxes are imposed at the state and local levels. North Carolinas boat sales tax is 3 and capped at 1500.

Is a boat motor tangible property. The local sales tax rates are relatively simple to follow as each county assesses either a 2 or 225 percent rate. The purpose of this sales and use tax manual is to provide businesses Department of Revenue employees and tax professionals a central summary of information concerning South Carolinas sales and use tax law and regulations.

101 primarily however some cities may be less. Beaufort yacht sales has worldwide contacts and assets to sell your. As you will see all are in regards to fulfilling boat property tax regulations in the Tar Heel state.

It must also include the name of the. And on top of those rates your municipality or county may. Generally there are three taxes of concern to boat owners.

6 with a tax cap of 500 Washington. Contact your Denison broker today for a more accurate estimate on your boats sales tax. The retail sale of a boat is subject to the 300 State rate of sales and use tax with a maximum tax of 1500 per article.

In the instance where sales tax has not been paid on the purchase of a boat a use tax at the 300 State rate with a maximum tax of 1500 per article applies to a boat purchased or received from. A Bill-Of-Sale can be typed or handwritten on plain paper. To that end the manual references specific authority.

Looking for input in regard to NC Tax on Transient boats. The highway use tax is due to be paid upon application for a certificate of title with the North Carolina Division of Motor Vehicles. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

Alabamas is 2 but has no cap. Statewide North Carolina Sales Tax Rate. Generally a business will report and remit use tax on Form E-500 Sales and Use Tax Return or through the Departments online filing and payment system.

Connecticut cut its sales tax from 635 to 299 on boats boat trailers boat. Varies between 8 to 10 depending on homeport. Durham Mecklenburg Orange and.

Find your NY rate here. The casual excise tax for a motor purchased alone is 6 with no maximum. Maximum Tax The maximum tax on the sale of a boat or vessel is 18000.

Boats are not subject to the local and transit rates of sales and use tax. Boats Aircraft Mobile Homes Unregistered vehiclesmotorcycles Trailers Campers and RVs nc boat sales tax. Boats in south carolina therefore are most at risk for.

Sales tax use or registration tax and personal property tax. An individual who purchases a boat or an aircraft must report the tax on Form E-555 Boat and Aircraft Use Tax Return. Lowest Effective Sales Tax Rate.

May need to leave my boat in NC waters for Dec Jan. NORTH CAROLINA SALESUSE TAXES 3 with 1500 Maximum Use Tax on boats Click Here for Brochure. Use tax information on boats and aircraft taxation of boats and aircraft sales of new or used boats and aircraft are subject to a collect north carolina tax.

The following items are considered taxable personal property in North Carolina and are required to be listed by the owner and are subject to tax based on their January 1st value. A boat sold alone is taxed at the lesser of 5 of the purchase price or 500. A boat motor sold alone is taxed at 6 of the purchase price.

By the end of the month in which the purchase was made to the North Carolina. Vessel sales tax in south carolina is capped at 300 and the corresponding use tax is at the same rate. The casual excise tax does not apply to boat trailers.

When it comes to flat rates the North Carolina sales tax on boats is 3 percent but capped at 1500 and in New Jersey its 33125 percent but in Florida its 6 percent and in Texas its 625 percent. And sales and use taxes are not imposed on the sale of a boat The tax is due on the gross sales price of the boat without any al-lowance for a trade-in. Additionally four counties have a 05 percent transit county sales and use tax.

Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 75. A business must report use tax on the applicable form. Highest Effective Sales Tax Rate.

The casual excise tax for a boat or boat and motor purchased as a package is 5 of purchase price with a maximum fee of 50000.

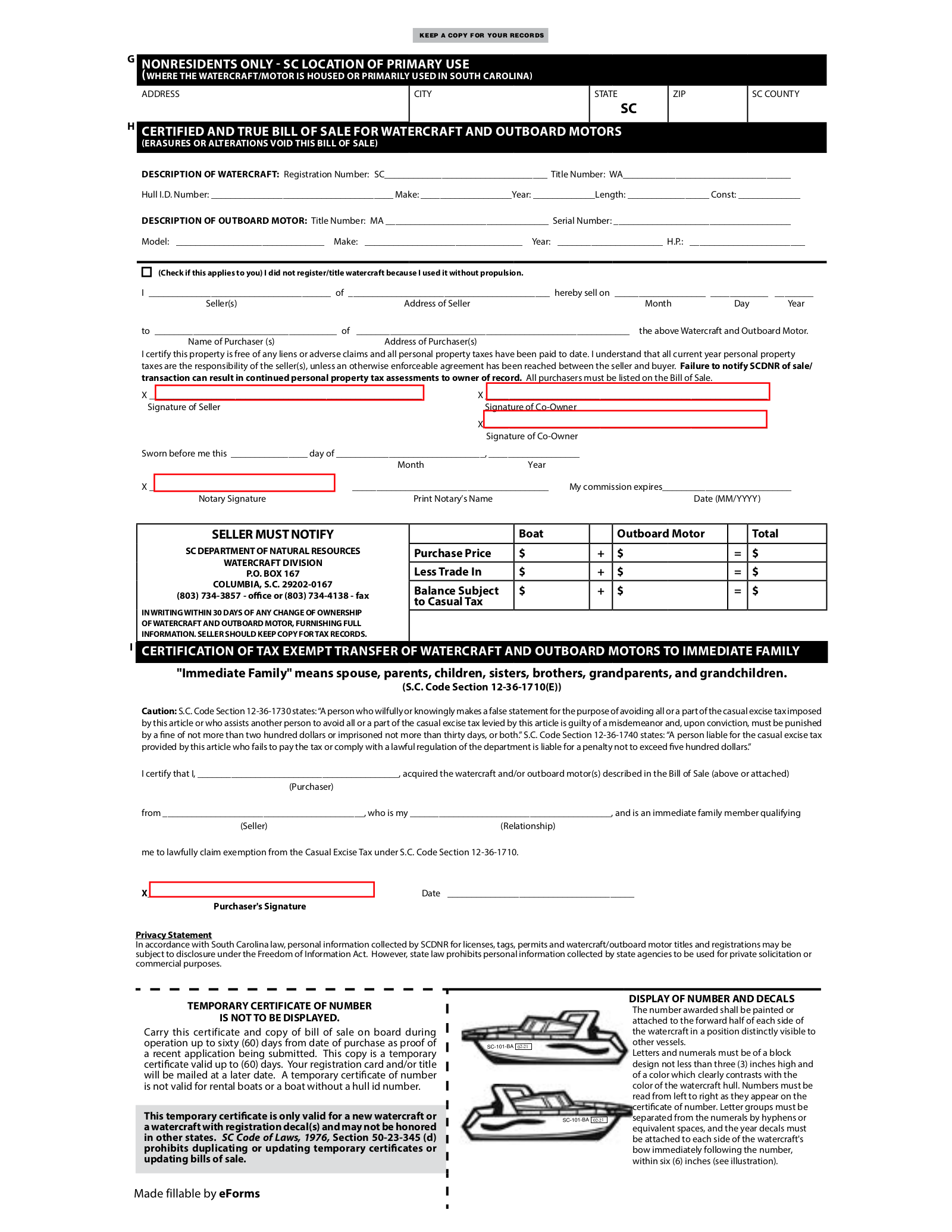

Free South Carolina Boat Vessel Bill Of Sale Form Pdf

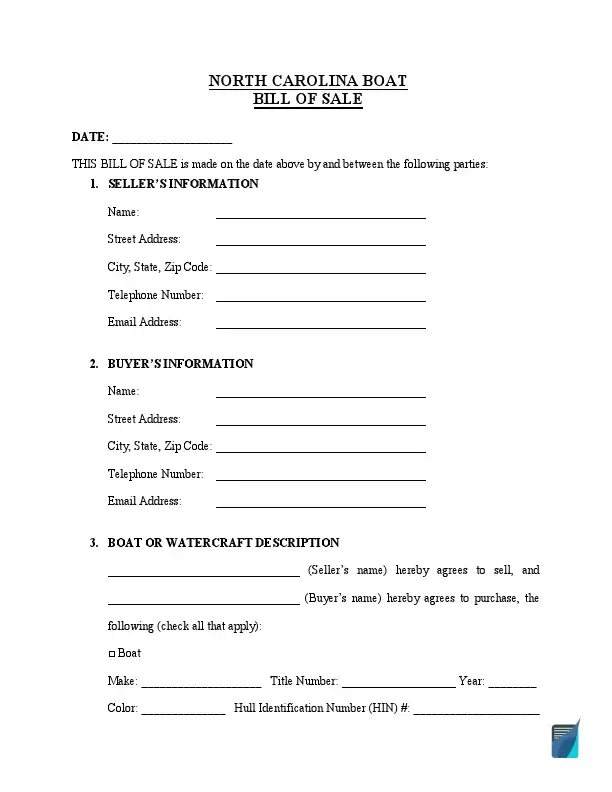

Free North Carolina Boat Vessel Bill Of Sale Form Pdf

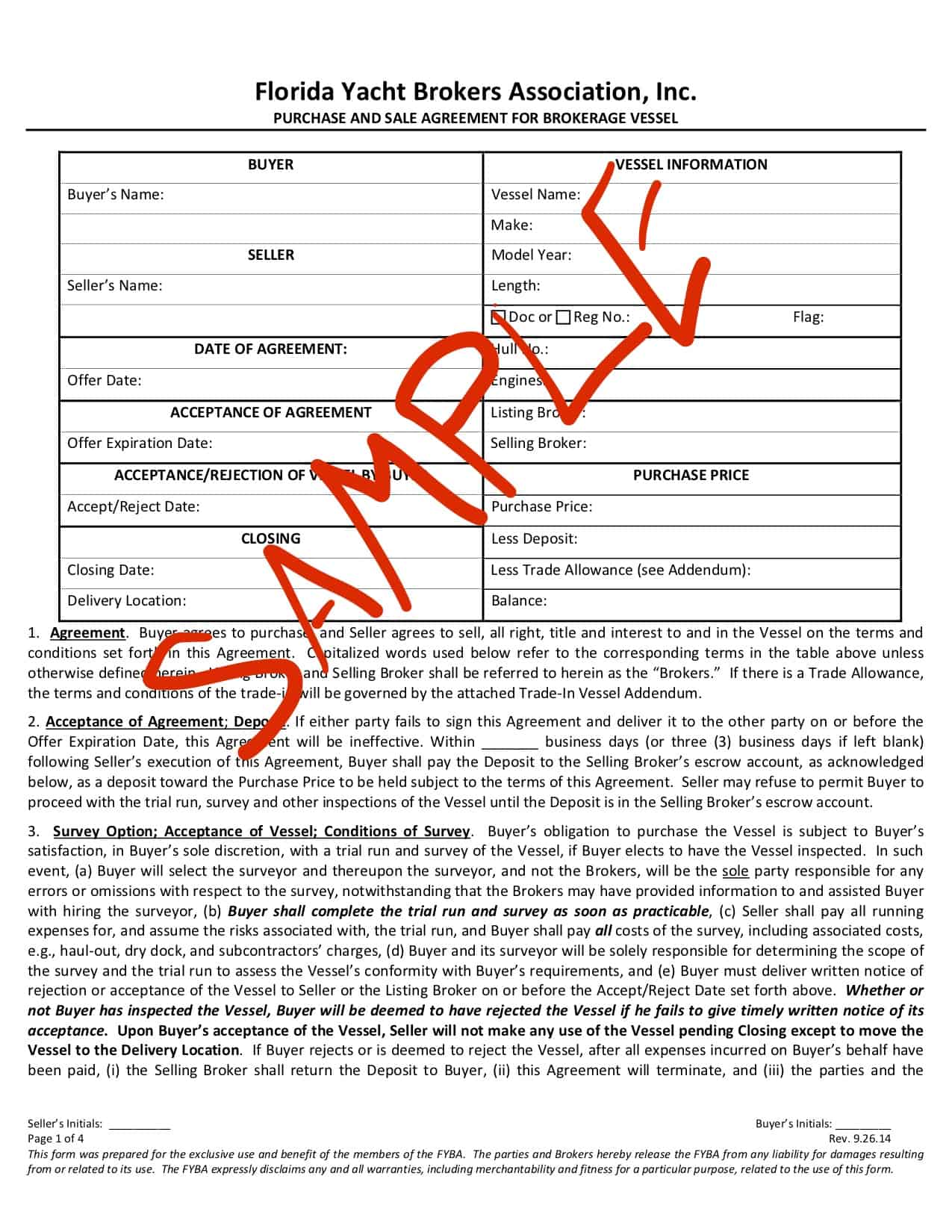

Yacht Sales Contracts Boat Taxes And Duties Some Basic Tips 1 Catamaran Resource

North Carolina Bill Of Sale For A Vessel Download Fillable Pdf Templateroller

Free North Carolina Bill Of Sale Form Pdf Template Legaltemplates

Free South Carolina Boat Bill Of Sale Form Pdf Eforms

Post a Comment for "Boat Sales Tax North Carolina"